Medicare in the USA – 2025 Guide to Plans, Costs & Benefits

July 25, 2025Best Auto Insurance in the USA – 2025 Expert Tips, Rates & Savings Guide

August 2, 2025Life insurance isn’t just a piece of paper — it’s a financial promise to your loved ones that they’ll be taken care of no matter what happens. In the United States, one of the smartest ways to customize and strengthen that promise is by adding riders and add‑ons to your life insurance policy.

In this complete 2025 guide, we’ll explore:

- What riders are and how they work

- The most popular riders in the USA

- How much they cost

- Real‑life examples of how riders protect families

- How to choose the right riders for your life stage

- Expert tips and answers to frequently asked questions

1. What Are Life Insurance Riders?

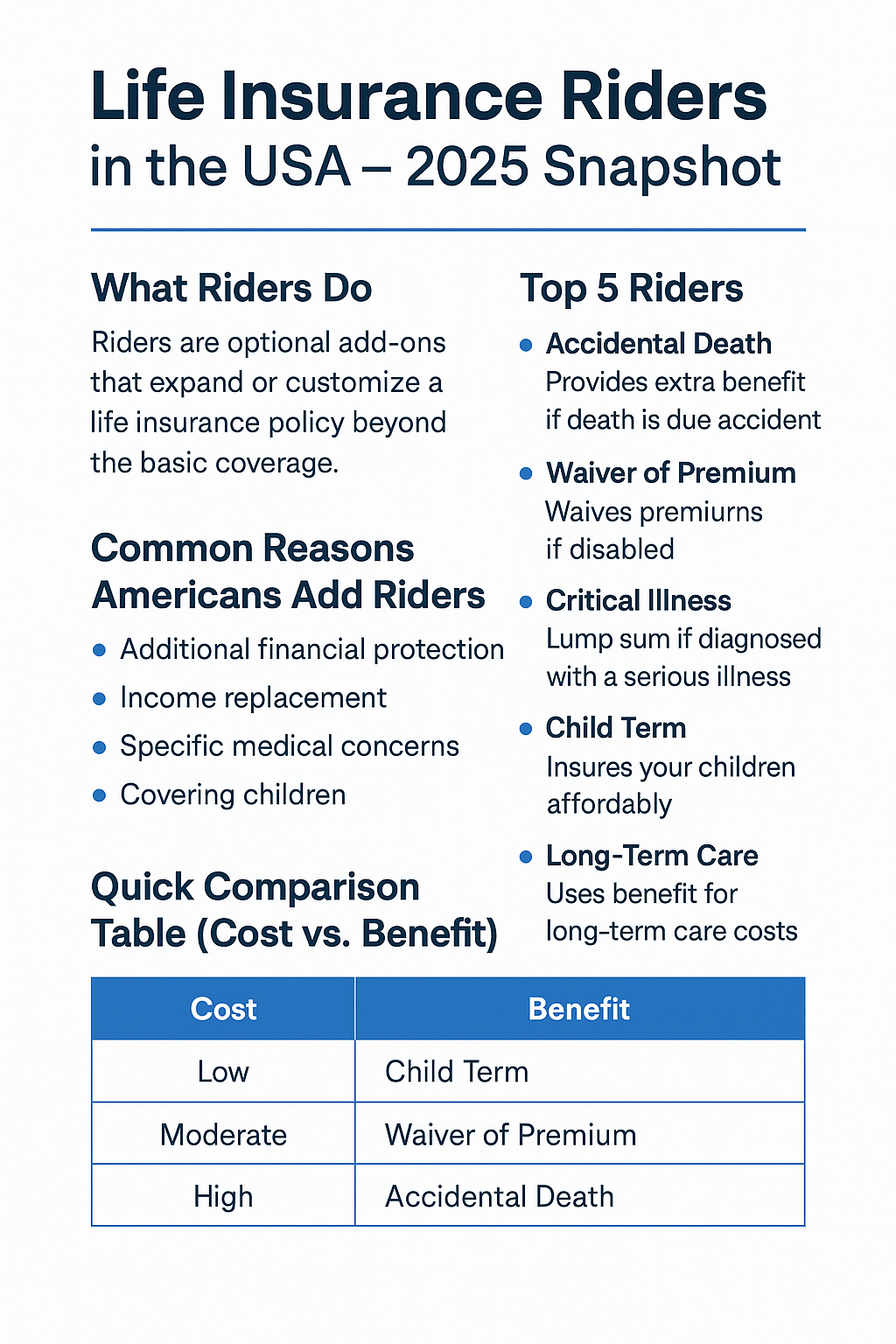

A life insurance rider is an optional feature you can add to your base life insurance policy to expand or customize coverage. Think of your policy as the main structure, and riders as extra rooms or features you can add to make it fit your exact needs.

Why they matter in the USA:

- High healthcare costs can drain savings quickly.

- Many Americans have mortgages, car loans, and student debt.

- Unexpected illnesses or accidents can cause serious financial disruption.

State‑level regulation: In the U.S., life insurance is regulated by state governments. That means rider availability, terms, and costs can vary depending on where you live.

2. Why Riders Are Important in the USA

In 2025, the cost of living and healthcare continues to rise. A standard policy may not be enough for every family’s unique needs. Riders offer:

- Targeted coverage for specific risks

- Extra protection at a relatively low cost

- Peace of mind for you and your family

Example: A $500,000 life insurance policy may sound like enough. But if you add an Accidental Death Benefit Rider, your family could receive $750,000 if you die in an accident.

3. Most Popular Life Insurance Riders in the USA (2025)

| Rider Name | What It Covers | Best For |

|---|---|---|

| Accidental Death Benefit | Extra payout if death is accident‑related | High‑risk jobs, frequent travelers |

| Waiver of Premium | Waives premium payments if you become disabled | Self‑employed, main earners |

| Critical Illness | Lump‑sum payout for cancer, stroke, heart attack | Anyone concerned about medical bills |

| Child Term | Low‑cost coverage for children under your policy | Parents |

| Long‑Term Care (LTC) | Use part of your death benefit for nursing home costs | Seniors, retirement planners |

4. Real‑Life Examples

Example 1: Accidental Death Benefit Rider

James, a 42‑year‑old truck driver in Texas, had a $400,000 policy plus a $200,000 accidental death rider. When a road accident tragically took his life, his family received $600,000, allowing them to pay off the mortgage, cover college tuition for both children, and secure long‑term savings.

Example 2: Critical Illness Rider

Sarah, 38, from Ohio, was diagnosed with breast cancer. Her policy included a $50,000 critical illness rider. This lump‑sum helped pay for out‑of‑network treatment, allowing her to focus on recovery instead of worrying about medical bills.

5. USA Usage Statistics

| Rider | % of Policies with This Rider |

|---|---|

| Accidental Death | 52% |

| Waiver of Premium | 41% |

| Critical Illness | 38% |

| Child Term | 22% |

| Long‑Term Care | 15% |

6. Benefits vs Drawbacks of Riders

| Benefits | Drawbacks |

|---|---|

| Affordable way to boost coverage | Increases monthly premium |

| Flexible and customizable | Not all riders available in every state |

| Can protect against specific risks | Some require medical exams |

| Often cheaper than separate policies | May expire after certain age limits |

7. How Much Do Riders Cost in the USA?

| Rider | Low Monthly Cost | High Monthly Cost |

|---|---|---|

| Accidental Death | $5 | $15 |

| Waiver of Premium | $8 | $15 |

| Critical Illness | $15 | $30 |

| Child Term | $5 | $8 |

| Long‑Term Care | 10% of premium | 20% of premium |

8. Choosing the Right Rider for Your Life Stage

Young Professionals (20s–30s)

Consider: Accidental Death, Waiver of Premium

Why: Affordable now, covers high‑risk years

Families with Children (30s–50s)

Consider: Critical Illness, Child Term

Why: Protects income and children’s future

Seniors & Retirees (50+)

Consider: Long‑Term Care, Critical Illness

Why: Prepares for healthcare and living costs

9. Expert Tips for Buying Riders

- Compare at least three insurers with A+ or better AM Best ratings

- Ask about free‑look periods (10–30 days to cancel for a full refund)

- Avoid over‑buying — focus on what’s relevant to your life

- Re‑evaluate riders every year as life changes

10. How to Add Riders to Your Policy

- When Buying: Add riders during your initial policy purchase

- After Purchase: Some can be added later, but may require new underwriting

- Annual Review: Adjust your policy as your needs change

11. Frequently Asked Questions (FAQs)

Q: Can I remove a rider later?

Yes, most riders can be removed, and your premium will be adjusted.

Q: Are life insurance payouts from riders taxable?

In most cases, death benefits are income‑tax‑free. Long‑Term Care rider benefits may be taxable in certain situations.

Q: Are riders worth the cost?

Yes, if they match your personal risks and provide meaningful financial protection.

12. Contact Our Experts

If you have more questions about life insurance riders or want expert guidance tailored to your needs, our licensed insurance professionals are here to help.

📧 Email Us for Expert Advice: Click here to contact our team

Fill in the form on our contact page, send us your question, and one of our experts will respond promptly.

Request a Call from a Local Agent

If you’d like a licensed health insurance agent in your area to reach out to you personally:

- Visit our Find Agents page

- Enter your location and details

- A local agent will contact you within 1–2 business days

💡 This service is free and there’s no obligation to purchase anything

13. Final Thoughts

Life insurance riders allow you to personalize your protection and prepare for life’s uncertainties. From accidental death coverage to long‑term care funding, the right riders can make your policy more powerful and better suited to your family’s needs.

Action Step: Compare quotes from top‑rated U.S. insurers today, ask about available riders in your state, and build a life insurance policy that truly grows with you.